In the realm of real estate, understanding market dynamics and trends is paramount to making informed decisions. In this blog post, we delve into an in-depth analysis of the real estate landscape in four prominent mountain resort counties: Eagle, Pitkin, San Miguel, and Summit. Through examining data spanning from 2013 to 2023, we aim to provide valuable insights into the trends shaping these markets. From fluctuations in sales transactions to shifts in average sales prices for both single and multi-family residences, this analysis offers a comprehensive overview of the evolving real estate dynamics in these sought-after regions. By deciphering these trends, investors and buyers can better navigate the complexities of the mountain resort real estate market and capitalize on emerging opportunities.

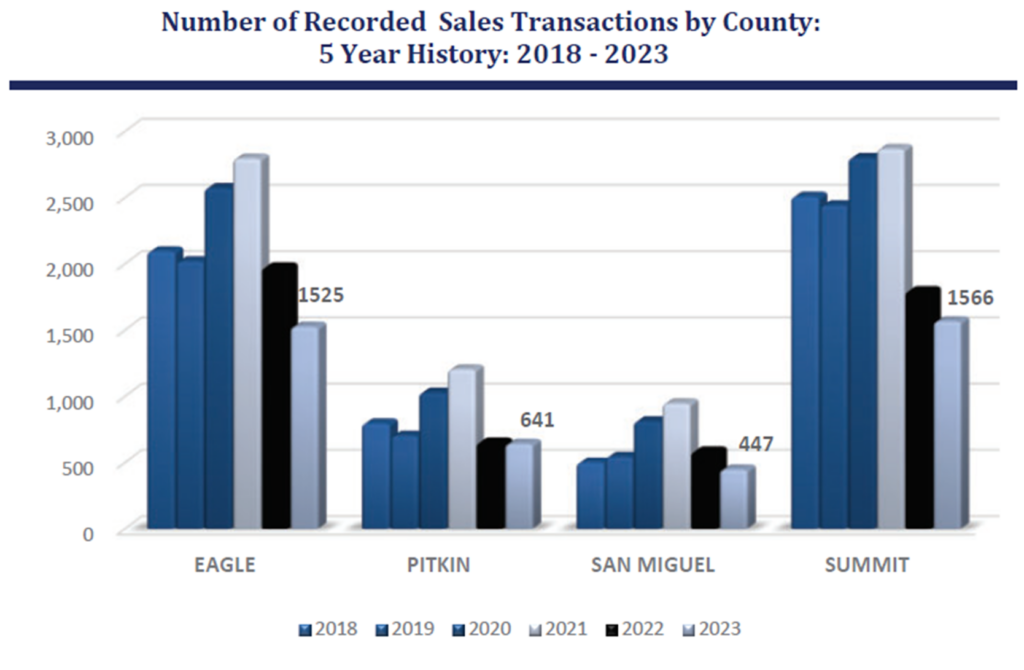

Number of Record Sales Transactions

The bar chart displays the number of recorded sales transactions by county over five years from 2018 to 2023. The chart shows data for Eagle, Pitkin, San Miguel, and Summit counties.

Key observations:

- Eagle and Summit counties consistently show the highest number of transactions over the five years.

- Pitkin County had a peak in 2019 but then saw a decrease.

- San Miguel County shows lower transaction volumes compared to the others, with a slight increase in 2023.

- Summit County shows a significant increase in transactions in 2023, indicating a possible surge in market activity or attractiveness to buyers.

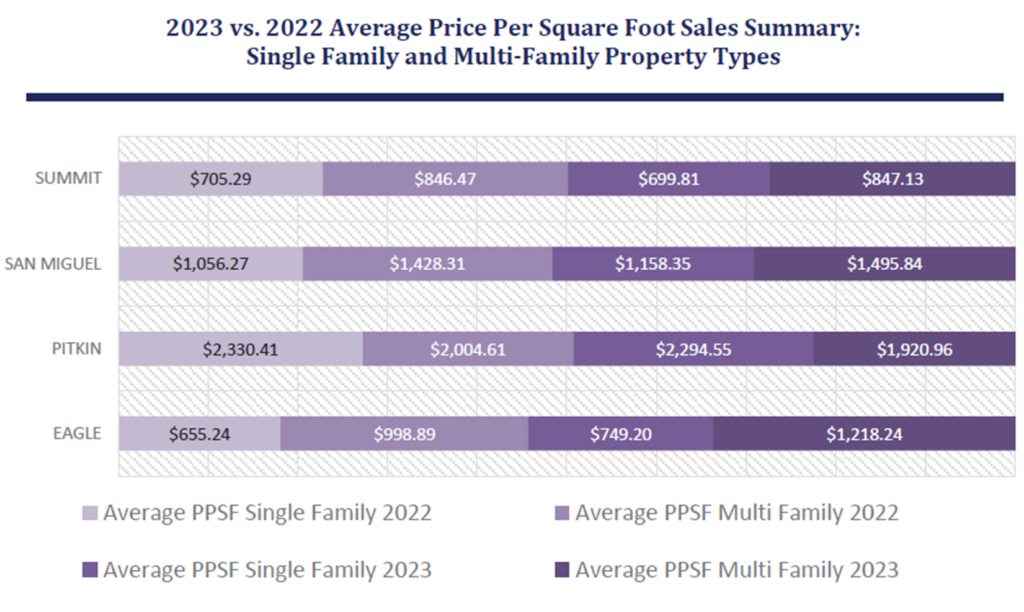

2023 vs 2022 Price Per Square Foot Sales

The chart compares the Average Price Per Square Foot (PPSF) for single and multi-family properties in four counties (Eagle, Pitkin, San Miguel, Summit) for 2022 and 2023. Across all counties, there’s a visible change in PPSF from 2022 to 2023, with multi-family properties generally commanding a higher PPSF than single-family homes. Notably, Pitkin County has the highest PPSF for single-family homes in 2023, while Summit County shows the most considerable increase in PPSF for multi-family properties from 2022 to 2023. This indicates varying market dynamics and possible shifts in demand between property types and locations.

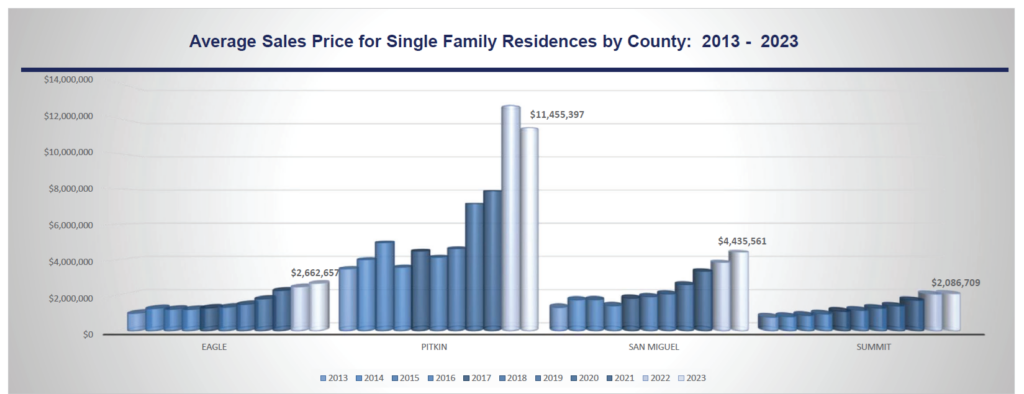

Average Sales Price for Single Family Homes

The provided bar chart shows the average sales price for single-family residences by county over an eleven-year period from 2013 to 2023. The chart includes data for Eagle, Pitkin, San Miguel, and Summit counties.

From the visual data, we can observe significant fluctuations in average sales prices across the counties:

- Eagle County shows a gradual increase over the years, starting from a lower price point.

- Pitkin County has the highest peaks, notably in the middle of the period, suggesting a period of exceptionally high property values.

- San Miguel also exhibits a peak, although not as pronounced as Pitkin’s, and shows some price volatility.

- Summit County displays more moderate growth, with prices rising steadily over time.

These trends suggest a dynamic real estate market with varying investment attractiveness and potential profitability. The spikes in average sales prices may indicate economic factors at play, such as market demand, investment trends, or local developments. It’s essential for investors and buyers to consider these trends when making decisions, as they reflect both the potential for return on investment and the overall health of the real estate market in these areas.

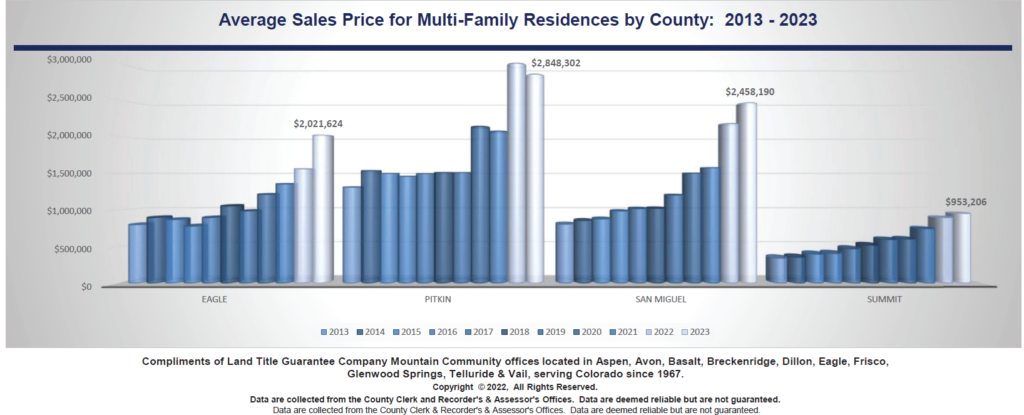

Average Sales Price for Multifamily Home Units

The bar chart you’ve provided shows the average sales price for multi-family residences by county from 2013 to 2023 for Eagle, Pitkin, San Miguel, and Summit counties.

The data indicates a significant growth in average sales prices across all counties, with Pitkin County standing out with the highest average sales prices, reaching above $2.8 million. San Miguel County also shows a substantial increase in prices, with a peak in 2023. Eagle County’s average sales prices show a steady climb over the years, while Summit County, despite fluctuations, presents a more modest increase in average sales prices for multi-family residences.

These trends suggest that the market for multi-family residences in these areas has been robust, with Pitkin and San Miguel counties being particularly strong markets. The steady rise in Eagle and the moderate growth in Summit may reflect a combination of factors, including market demand, housing availability, and economic conditions specific to those areas.

The data highlights how important it is to those considering entering the resort real estate market to make educated choices. The trends in the last five years provide insights into the challenges this specific market faces, whether you’re looking for a vacation house or an investment opportunity. In conclusion, the market for real estate in mountain resorts is still resilient, which points to the attraction of living in the mountains. This area is an attractive option for both personal and investment endeavors due to its unique combination of luxury, adventure, and the beauty of nature. The next few years in this market will be interesting to watch.

**Data and Graphs Sourced from Land Title Guarantee Company**